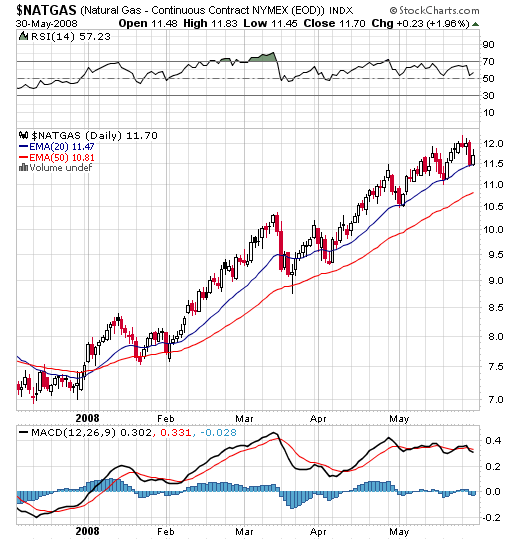

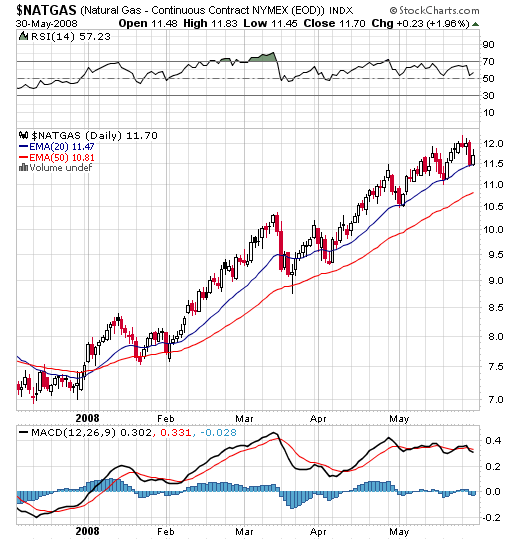

Watch for natural gas (currently at $11.90 per Mcf) to take out its December 2005 high of $15 in the next couple months in my opinion. As crude oil continues to gain traction and continues to make new highs it only puts added pressure on the price of natural gas as natural gas is widely known as the cleanest, most efficient energy source viable of replacing crude oil in the future. While natural gas is already being accumulated by large institutions preparing to play the energy of the future (notice the strong support at the 20 day EMA), the momentum crowd has yet to begin piling into the commodity as crude oil continues to maintain its luster as life of the commodity party. Sometime in the next couple of months, however, I believe natural gas prices will begin picking up in velocity and begin outpacing moves in crude oil. I expect natural gas prices to breach their December 2005 high and hit the $15-17 level and possibly higher. Now in terms of plays, to get the most bang for our buck an optimal play would be a small cap low float unhedged natural gas producer. This brought me to Royale Energy (ROYL). The company currently trades at $5.17 per share, has a mere $41M market cap, a 4.65M share float, is completely unhedged, and has been ramping natural gas production by putting new natural gas wells online. Not only that, they currently own 15,000 net acres in Utah's Uintah Basin where very large players such as Anadarko Petroleum are reporting that they have discovered enormous natural gas reserves. Anadarko which owns 225,000 acres in the Uintah Basin is estimating as much as 9 trillion cubic feet of potential reserves in the area just south of Royale's acreage. Royale has already begun exploring their acreage in the Uintah Basin as of late last year and has already successfully struck natural gas. This is an excerpt from last year's October press release:

"San Diego, November 27, 2007 – Royale Energy, Inc. (NASDAQ: ROYL)- Royale announces a new gas discovery and the successful completion and fracture stimulation of the V Canyon 20-1 well in the Uintah Basin.

On October 30th the completion rig was moved from the Ten Mile Canyon 22-1 well, to begin completion operations of the V Canyon 20-1. The well encountered multiple potentially productive zones including the Mesa Verde, the Sego, the Castlegate, the Mancos shale, the Dakota, the Brushy Basin, the Entrada and the Wingate. Out of a total of 60 feet of potentially productive Entrada, Royale selected the best 20 feet in the middle of the zone for perforation. This 20 foot section flowed gas naturally at an initial rate of 1.3 MMcf (million cubic feet) of gas per day and stabilized at 882 Mcf per day. Royale then decided to further stimulate by performing a fracture stimulation (“frac”) of this zone which increased the production capacity of the zone, resulting in an initial rate of 1.8 MMcf per day and stabilized flow rate of 1.04 MMcf of gas per day with higher tubing pressure. The well is currently being prepared for production and connection to the pipeline that runs

immediately north of the well."

Last week I spoke to the company, and they informed me that we may be hearing about the reserves found in the Uintah Basin in this upcoming month which they said would be "very exciting news." This news has potential to double the stock alone, and with additional wells coming online, as well as natural gas prices continuing to move higher, I expect Royale's share price trend to continue much higher, with eventual natural gas momentum taking this parabolically higher. The technicals look amazing as well as the stock is forming a bullish pennant after a high volume breakout from the $3 level, and is now finding strong support at the 10 day EMA. The stock is a buy here in the $5s with an initial target of +$10.