Friday, June 27, 2008

Multilateral US Dollar Intervention Likely On The Horizon...

With the Fed's credibility waning, market technicals broken, commodities on the verge of major breakouts, and the US Dollar within striking distance of new lows we believe we are now in the red zone for an aggressive move by the US government to intervene in the foreign exchange market and stem the slide in the US dollar. The dollar slide has undoubtedly been the culprit for much of the markets malaise, as its relentless decline has put significant upside pressure on commodities pushing oil and gasoline to all time highs. With the Fed unable to adjust monetary policy favoring a strong dollar (i.e. higher rates) for fear of adding further strains on an already cash-strapped consumer, we are looking for the US government to step in and use the untraditional measure of intervention within the foreign exchange market in an attempt to not only break the back of a raging bull market in commodities, but more importantly regain global confidence in the greenback and the US financial system. We are looking for the US government to step in multilaterally, joining hands with their european counterparts as europeans also view the soaring euro as an unwelcome hinderance to domestic growth due to the fact that it makes their goods more expensive to foreign buyers and thereby makes them less competitive in the global marketplace. We are looking for possible intervention this sunday night or next week, and as such have taken a long position in the July 115 DIA calls here at $1.76 as the DOW is now firmly in oversold territory, and either way a bounce is very likely next week.

Monday, June 23, 2008

Royale Energy (ROYL) Strikes Oil, Stock Set To Go Parabolic...

As we've mentioned many times over the past several weeks, we have been aggressive buyers of ROYL on every dip, and with the company putting out an operational update minutes ago we couldn't be more excited about the prospects of the company, and feel very strongly that the stock is setting up for a parabolic move to the upside here a la PDO as in addition to extremely bullish findings of natural gas in their Uintah Basin acreage, they have also discovered what might possibly be a huge pool of oil.

Here are some excerpts specifically regarding the addition of oil to Royale's growing asset base:

"In addition, the Company believes the shallow Castlegate formation that is part of the Mesa Verde group of sands is shown on the logs to be present in two of the Company’s wells and covers a large area. This formation has shown both natural gas in the most updip location, as well as tar in the structurally lower position. If productive, this zone could result in production of both natural gas and oil from an area of almost three miles of structural dip."

"In California’s San Joaquin Basin, Kern County, Royale intends to drill an additional penetration of the Monterey oil shale. After analyzing the results of its last completion (Weber 27x-27) the Company will follow completion procedures that were developed in its latest test that resulted in the Monterey formation free flowing to the surface without pumping. Royale believes this to be extremely significant considering all of the Company’s previous perforations of the Monterey shale never achieved this. In addition, the oil cut has increased substantially over previous tests."

We did not expect these new oil finds and view this as an extremely bullish finding as we expect them to use a parallel strategy to their natural gas production of selling the Oil on a completely unhedged basis. In addition, the CEO stated that Royale has returned back to profitability this quarter and are looking for continued profitability for the foreseeable future, which is also excellent news. We are upping our initial target from the $15-20 range to $20-25 based on our belief that Royale's current $80M market cap does not accurately reflect the company's growing asset base and 100% unhedged natural gas production. As such we continue to hold ROYL as our top pick in the energy space.

Here are some excerpts specifically regarding the addition of oil to Royale's growing asset base:

"In addition, the Company believes the shallow Castlegate formation that is part of the Mesa Verde group of sands is shown on the logs to be present in two of the Company’s wells and covers a large area. This formation has shown both natural gas in the most updip location, as well as tar in the structurally lower position. If productive, this zone could result in production of both natural gas and oil from an area of almost three miles of structural dip."

"In California’s San Joaquin Basin, Kern County, Royale intends to drill an additional penetration of the Monterey oil shale. After analyzing the results of its last completion (Weber 27x-27) the Company will follow completion procedures that were developed in its latest test that resulted in the Monterey formation free flowing to the surface without pumping. Royale believes this to be extremely significant considering all of the Company’s previous perforations of the Monterey shale never achieved this. In addition, the oil cut has increased substantially over previous tests."

We did not expect these new oil finds and view this as an extremely bullish finding as we expect them to use a parallel strategy to their natural gas production of selling the Oil on a completely unhedged basis. In addition, the CEO stated that Royale has returned back to profitability this quarter and are looking for continued profitability for the foreseeable future, which is also excellent news. We are upping our initial target from the $15-20 range to $20-25 based on our belief that Royale's current $80M market cap does not accurately reflect the company's growing asset base and 100% unhedged natural gas production. As such we continue to hold ROYL as our top pick in the energy space.

Wednesday, June 18, 2008

Sell Half PDO FPP Shares, Let The Rest Ride As Oil Set To Make New Highs...

We have taken half of our positions off PDO and FPP at $29.50 and $7 respectively and are letting the rest of our shares ride. While we believe both stocks are headed higher on fresh highs in crude Oil, we must be prudent in taking some profits off the table after a 58% run in PDO shares from our $18.60-$18.70 entry and a 38% run in FPP shares from our $5.02-$5.07 entry taken 2 weeks ago (see our June 5th blog post). With the July contract in crude expiring this friday we expect Oil to be highly attracted to the $140 level as hedge funds clearly continue to be net long Oil and have an interest in closing Oil strong into expiration. As such we continue to hold half our PDO and FPP positions as well as 100% of our ROYL position as we believe energy prices will continue to be elevated with pressure to the upside. Natural gas continues to be our favorite sector in the market right now as we believe the $15-17 level in spot prices is inevitable, and we therefore continue to be huge holders of ROYL as the company remains completely unhedged and continues to increase natural gas production.

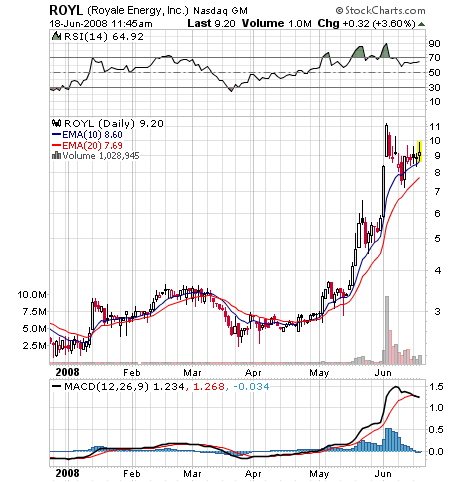

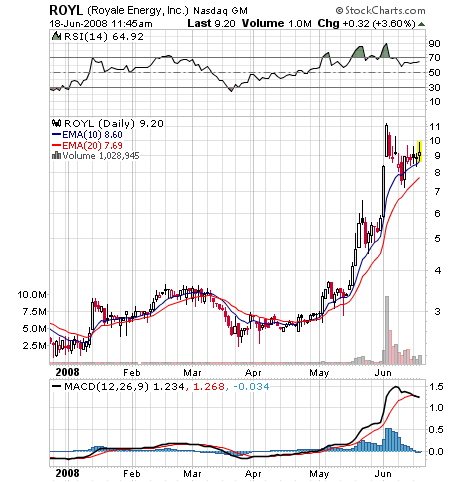

Royale Energy (ROYL) Preparing For High Volume Breakout To New Highs...

We have added to our ROYL position here at $9.26 as the stock looks prepped for a high volume breakout to the upside today or tomorrow. Note that ROYL is flagging exactly as it did in the $5s just before it broke out to the $11s. We are looking for a similar breakout here to new highs +$11.30 shortly. Note that nat gas prices are showing remarkable relative strength versus crude, with nat gas continuing to make new highs even in the face of any short term weakness in crude.

Monday, June 16, 2008

SatCon (SATC) In Bed With Google...

It appears SatCon is also in bed with Google:

SatCon was key in Google's solar farm

Published: June 27, 2007 at 2:36 PM

BOSTON, June 27 (UPI) -- Boston's SatCon Technology Corp. had a hand in the recent installation of one of the world's largest solar arrays.

The solar farm at Google's corporate headquarters in Mountain View, Calif., was in part due to Boston-based SatCon Technology's PowerGate inverters.

SatCon is a developer of power management and system architecture solutions for the alternative energy and distributed power markets.

The company's PowerGate commercial grade inverters were an integral part of the recent installation at Google's Mountain View campus. Google officials say the new 1.6 megawatt system is the largest commercial photovoltaic system in the United States.

Sharp Corp. provided 9,212 208-watt modules for the project, which was designed and installed by EI Solutions. SatCon's PowerGate high-efficiency inverters are a critical component of the system, converting the sun's energy produced by the photovoltaic panels into alternating current electricity that is used to power the facility.

Officials estimate Google's new solar array could prevent as much as 3,637,627 pounds per year of harmful greenhouse gases annually. Over the next 30 years, the carbon dioxide reduction will be equivalent to eliminating more than 128 million car driving miles.

SatCon's trademarked PowerGate inverters are designed for use with alternative energy power systems to generate distributed electrical power. Distributed, alternative energy power generation is a growing trend toward the production of clean, reliable power at the point of use. Alternative energy systems can alleviate congestion on highly loaded utility electrical distribution networks and offer an alternative to power line extensions in remote areas.

© 2007 United Press International. All Rights Reserved.

This material may not be reproduced, redistributed, or manipulated in any form.

SatCon was key in Google's solar farm

Published: June 27, 2007 at 2:36 PM

BOSTON, June 27 (UPI) -- Boston's SatCon Technology Corp. had a hand in the recent installation of one of the world's largest solar arrays.

The solar farm at Google's corporate headquarters in Mountain View, Calif., was in part due to Boston-based SatCon Technology's PowerGate inverters.

SatCon is a developer of power management and system architecture solutions for the alternative energy and distributed power markets.

The company's PowerGate commercial grade inverters were an integral part of the recent installation at Google's Mountain View campus. Google officials say the new 1.6 megawatt system is the largest commercial photovoltaic system in the United States.

Sharp Corp. provided 9,212 208-watt modules for the project, which was designed and installed by EI Solutions. SatCon's PowerGate high-efficiency inverters are a critical component of the system, converting the sun's energy produced by the photovoltaic panels into alternating current electricity that is used to power the facility.

Officials estimate Google's new solar array could prevent as much as 3,637,627 pounds per year of harmful greenhouse gases annually. Over the next 30 years, the carbon dioxide reduction will be equivalent to eliminating more than 128 million car driving miles.

SatCon's trademarked PowerGate inverters are designed for use with alternative energy power systems to generate distributed electrical power. Distributed, alternative energy power generation is a growing trend toward the production of clean, reliable power at the point of use. Alternative energy systems can alleviate congestion on highly loaded utility electrical distribution networks and offer an alternative to power line extensions in remote areas.

© 2007 United Press International. All Rights Reserved.

This material may not be reproduced, redistributed, or manipulated in any form.

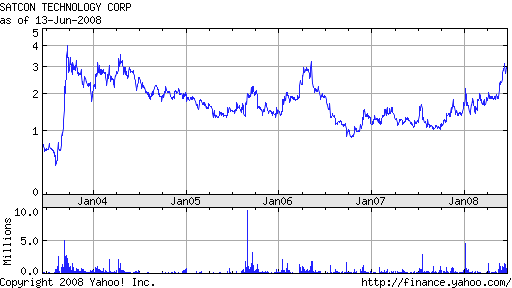

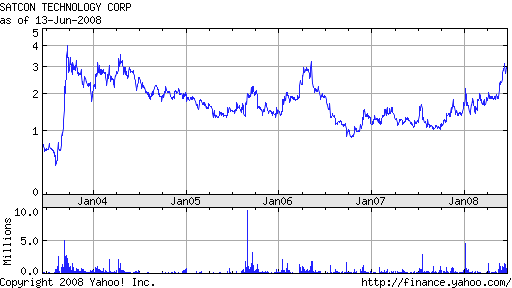

Buy SatCon Tech (SATC) As Stock Set For Major Breakout...

We are buying SATC here under $3.10 as we believe the stock is setting up for a major breakout above its May 2006 high at $3.30 taking it to its September 2003 high of $4.30 near term. If the stock can breach the $4.30 level the sky is the limit as there is no resistance in the area just above it. The company provides energy conversion technology to the alternative energy space and has shown extremely strong year over year revenue growth of 79% with growth across all major product lines. This stock reminds us of a baby Energy Conversion Devices (ENER) and with that stock making new highs today, we expect the market to sit up and take notice of SATCs similar business line leading to a strong move in the stock. Initial target $4.30, with upside to $10 should we breach the September highs.

Wednesday, June 11, 2008

Reinitiate Position In Royale Energy (ROYL) Here @ $7.40...

We believe the stock has bottomed here, and are looking for the next upleg to begin today or tomorrow. Natural gas prices remain firm with a strong bias to the upside. We also have a $4M round of financing out of the way, and we are now looking for news on new nat gas wells or the Uinta Basin to launch us to the upside.

Thursday, June 5, 2008

MXC PDO FPP Preparing To Squeeze As Oil Headed To New Highs On Another Round of Dollar Selling...

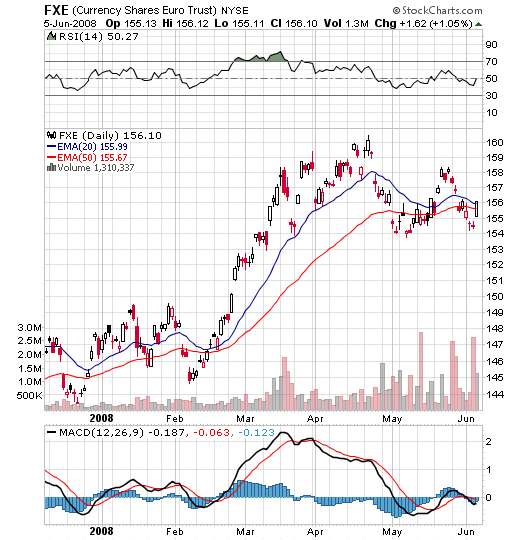

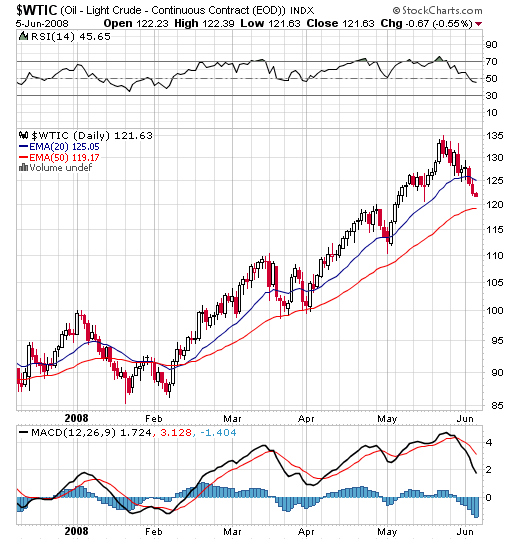

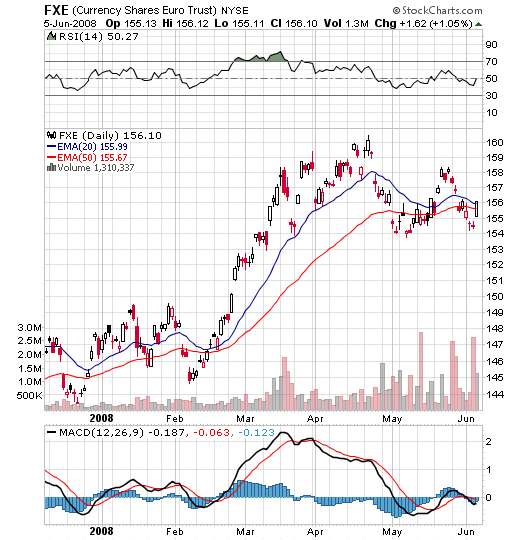

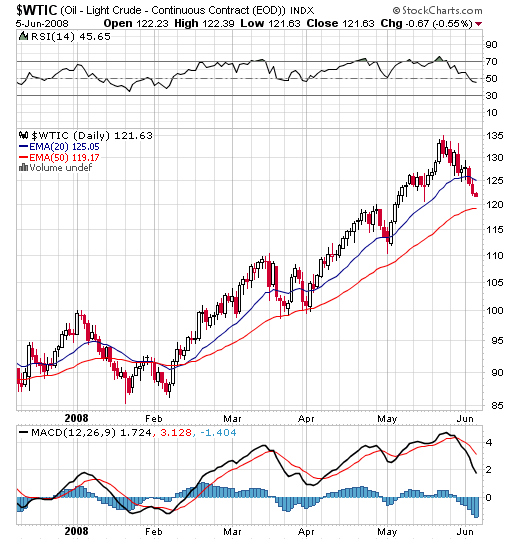

Oil has now completed a 50% retracement of its move from the $110 breakout level to the recent high of $135. After testing the $122.50 retracement level we saw an explosive +$5 move up in crude today on the heels of another round of dollar selling pushing the Euro back above $1.56. This move was triggered after ECB president Jean Claude-Trichet stated that the European Central Bank was prepared to raise interest rates next month which would again put new pressure on the dollar as higher interest rates overseas tend to push up demand for euros as global investors seek to lock in higher rates. Furthermore, looking at the chart of the FXE which tracks the EUR/USD we can see that there is a near perfect double bottom at the $1.54 level, and today seems to be the beginning of the next leg up which we firmly believe will take the Euro back to the $1.60 level thereby pushing crude back to new highs above $135. Moreover, note the strength in MXC PDO and FPP on the charts, as crude oils +$10 move off its highs only brought new buyers in creating nice consolidation patterns in all 3. All 3 are trading above their 10 day EMAs and we view this as a sign of strong accumulation here at these levels, and we expect short squeezes to commence in the very near future as shorts have now found themselves trapped in these low float energy stocks. Another round of momentum brought on by new highs in crude oil have potential to push all 3 above their recent 52 week highs. As such we have taken positions in both PDO and FPP at $18.60-18.70 and $5.02-5.07 respectively. While we would have liked to play MXC as well, the liquidity is a bit too light for our liking.

Tuesday, June 3, 2008

Sell Half ROYL Position, Let The Rest Ride...

After an enormous high volume run up in ROYL shares we are taking half our position off the table here at 10.80-10.90 in afterhours from our $5.17 entry. We feel it is only prudent to protect some of our profits, as momentum has found its way here and we need to lock in some of our 100% gains and begin looking for greener pasture. Technicals are clearly overbought now with an RSI just under 90 so we would like to see a nice pullback to possibly reposition ourselves. We still believe the stock should be valued much higher in the $15-20 range, and as such we continue to hold half our position for higher prices.

Monday, June 2, 2008

Stay 100% Long Royale Energy (ROYL): Initial Target Upped to $15-20 Based on Value of Uintah Basin Property...

For new ROYL longs please revisit last week's Wednesday May 28th blog for a complete recap of our bullish position on Royale Energy. For longs that are in with us from last week, well we are sitting pretty here as the stock has made a very significant breakout today on the strongest volume since 2005. While we would normally take profits here after a quick +60% pop from our entry, we are recommending holding all shares and are upping our initial target from $10 to the $15-20 range. We are basing our target on the significant value of their Uintah Basin property in Utah which has not only been validated by Anadarko's estimates of as much as 9 trillion cubic feet of nat gas on their 225,000 acres just south of Royale's, but has also just recently been validated by Whiting Petroleum's (WLL) $365M all cash acquisition of 11,534 net acres in the Uintah Basin from Chicago Energy Associates.

Here is a link to the PR put out by WLL after the close on friday which may explain the breakout in ROYL today:

http://biz.yahoo.com/prnews/080530/laf054.html?.v=98

Based on Whiting's $365M acquisition price which translates to $31,645 per net acre, it puts a value of approximately $475M on Royale's 15,000 net acres which are adjacent to WLL's newly acquired property. Now maybe my math is off, and maybe there is less natural gas in Royale's acreage so let's be ultra conservative and discount the value of Royale's property by 50% to $237.5M. Even after today's significant breakout, Royale's current market cap sits at a mere $65M! Which means anyway you slice it, Royale is extremely undervalued here and leaves room for enormous upside. Hence, based on the possible value of Royale's property, we are upping our initial target to $15-20 thereby giving ROYL a more reasonable yet still undervalued market cap of $118M -158M. Now as we have said before we spoke to the company a week or so ago, and they informed us that we may actually be hearing of the amount of reserves found in their Uintah Basin property this month which they said would be "very exciting news." Once this news arrives it will definitely give us more color on how much to value the property. As of now however, we highly recommend staying completely long ROYL shares till at least $15 as the company sits squarely in the crosshairs of an ongoing bull market in natural gas.

Here is a link to the PR put out by WLL after the close on friday which may explain the breakout in ROYL today:

http://biz.yahoo.com/prnews/080530/laf054.html?.v=98

Based on Whiting's $365M acquisition price which translates to $31,645 per net acre, it puts a value of approximately $475M on Royale's 15,000 net acres which are adjacent to WLL's newly acquired property. Now maybe my math is off, and maybe there is less natural gas in Royale's acreage so let's be ultra conservative and discount the value of Royale's property by 50% to $237.5M. Even after today's significant breakout, Royale's current market cap sits at a mere $65M! Which means anyway you slice it, Royale is extremely undervalued here and leaves room for enormous upside. Hence, based on the possible value of Royale's property, we are upping our initial target to $15-20 thereby giving ROYL a more reasonable yet still undervalued market cap of $118M -158M. Now as we have said before we spoke to the company a week or so ago, and they informed us that we may actually be hearing of the amount of reserves found in their Uintah Basin property this month which they said would be "very exciting news." Once this news arrives it will definitely give us more color on how much to value the property. As of now however, we highly recommend staying completely long ROYL shares till at least $15 as the company sits squarely in the crosshairs of an ongoing bull market in natural gas.

Subscribe to:

Posts (Atom)