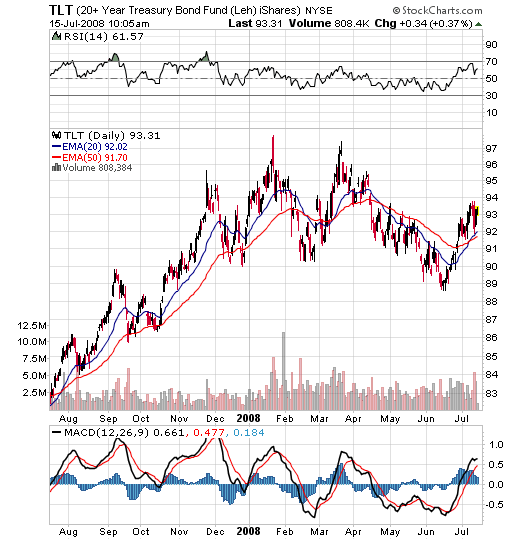

In essence, what is happening is that the US government is taking on very large amounts of debt at the same time that their revenue base (i.e. tax collection) is declining due to higher unemployment and high inflation which curbs consumer spending on discretionary items and hence produces slower growth for US corporations and therefore less corporate tax generation. Think of the US as a large company with debt levels climbing significantly and revenue and profit declining. What usually happens in a situation like this? Well lenders usually begin to become much less willing to lend capital at prevailing rates, and at the same time the debt-laden institution is more likely to want to raise additional capital to maintain sufficient debt to equity ratios (and/or bailout failing financial institutions). The rising debt levels coupled with declining income lead to the perception of a higher probability of default (even if slightly) and the higher probability gets priced into borrowing costs in the form of higher rates needing to be paid to lenders. What will happen is that demand for newly issued treasuries will begin to wane and large current holders of bonds (ie China and Japan) will likely be more inclined to reduce their holdings of US debt as risk levels associated with these bonds rise in conjunction with the fact that the value of these bonds continue to decline due to the devaluation of the dollar. You can see how a situation like this turns into a rather vicious circle, with weak fundamentals affecting dollar values and dollar values causing a negative change in behavior which in turn puts pressure on fundamentals. High inflation coupled with slow growth, rising unemployment, a weak currency, and rising debt levels is likely the worst situation an economy can be in which is why monetary policy is seen as so critical in maintaing all-important price stability. When inflation begins to soar, and central banks begin to lose credibility in containing inflation expectations it is very difficult to work an economy back to stable ground without severe consequences. Hence, we are expecting the yield on the 30-Year Treasury Bond to go much higher than the 4.44% it currently sits at as the risk associated with holding US debt increases and the expectation of prolonged high inflation begins to take form. Note that while the Fed has full control over rates at the short end of the yield curve (ie Fed Funds Rate), the Fed has zero control over yields at the long end which are completely set by open market forces.

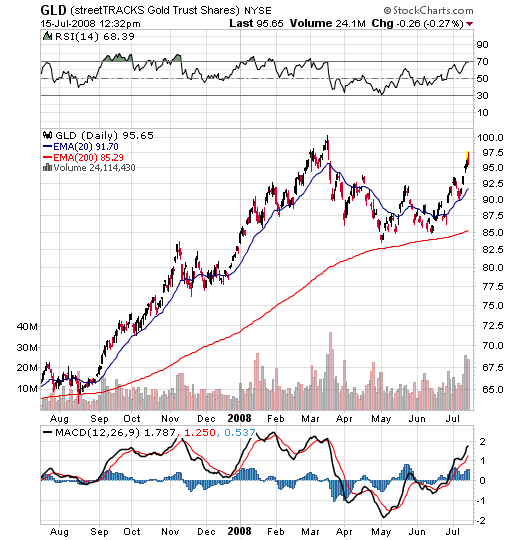

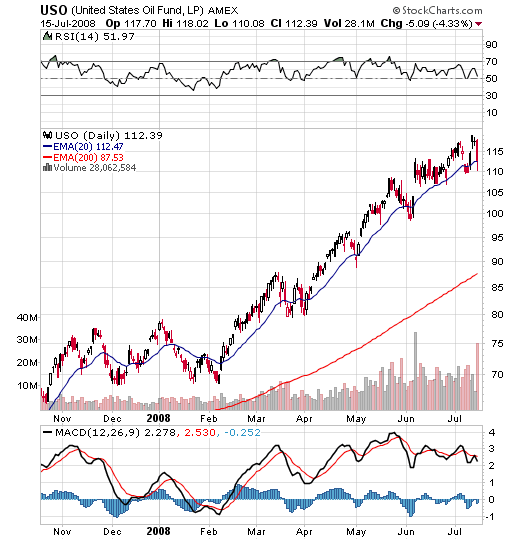

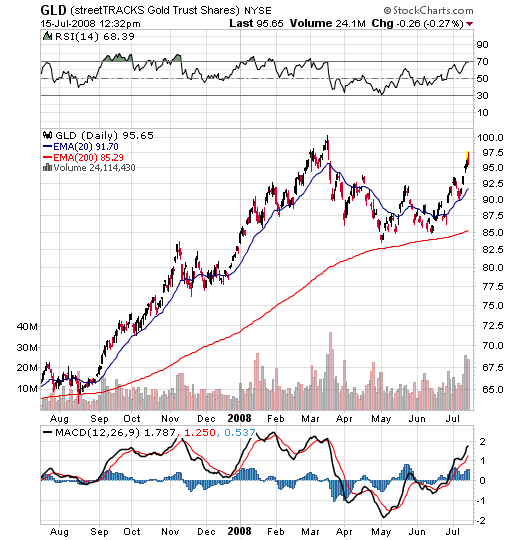

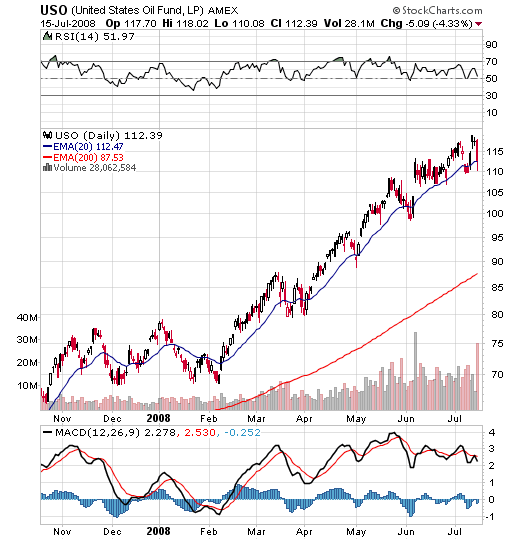

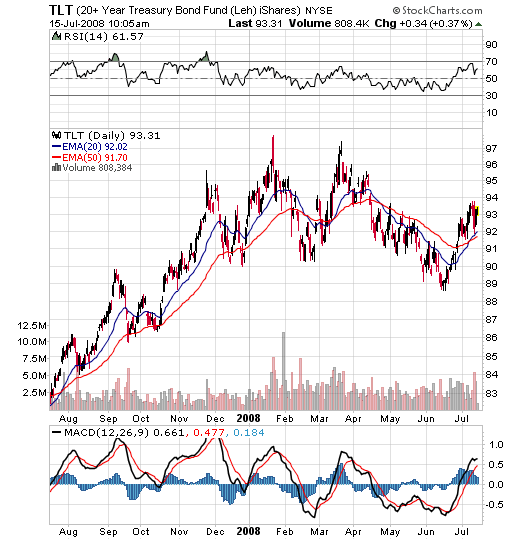

Now looking at the trades, Gold has several things going for it on a fundamental as well as technical basis. First off, we are in a financial storm predicated on worries over the soundness of financial institutions and the inherent value of the US dollar. This is the perfect backdrop for gold, as global investors tend to run to the yellow metal as the ultimate safe haven in times of uncertainty within the financial system. Secondly, inflation expectations remain high and the dollar continues to weaken. Thirdly, central bank diversification out of US bonds is likely to benefit gold as central banks tend to increase their gold holdings in times of uncertainty and environments where risk aversion is prevalent. Fourthly, the recent double bottom at 85 on the GLD chart looks eerily similar to the double bottom at 80 we spotted on the USO chart back in March which ultimately presaged Oils parabolic move from the 80s to 140s. Take a close look at the USO chart below, paying particular attention to the mid March 2008 to early April 2008 double bottom at 80. Now stretch it out over a couple months rather than one month, and notice how closely it resembles the mid April to mid June double bottom at 85 on the GLD chart. They are almost perfect replicas and we believe we are at the same exact stage of the Gold breakout with respect to Oil....just beginning a major move to the upside. Moreover, with Oil nearly doubling over the past year and significant percentage gains made, it is likely that hedge funds and large institutions are now in search of the next asset class which may have greater potential for larger percentage gains down the road. This will likely lead them to Gold, as the asset class is similar and it keeps them highly hedged against inflation. Hence, with fundamentals as well as technicals in place we believe that Gold has potential to become the new Oil going into year end, and are looking for a very strong double top breakout over 100 in the GLD very soon. In this kind of environment, with inflation expectations running high as well as multiple looming bank failures there really is no limit to how high Gold can go. Would it surprise me to see $1500-2000/oz by year end? No. Based on these assumptions, we have been buying the September 100 GLD calls here and will likely sit on these until Gold breaks out over $1000. Also note that large institutions have been taking extremely large positions in these calls over the past few sessions, with over 60,000 calls being bought yesterday and over 110,000 in open interest. Second of all, we have also been buying the September 90 puts on the TLT which is iShares Lehman 20+ Year Treasury Bond ETF. It essentially tracks bond prices at the long end of the yield curve, and since we are bearish on bonds going forward we'd like to have some exposure to the downside move.

Now looking at the trades, Gold has several things going for it on a fundamental as well as technical basis. First off, we are in a financial storm predicated on worries over the soundness of financial institutions and the inherent value of the US dollar. This is the perfect backdrop for gold, as global investors tend to run to the yellow metal as the ultimate safe haven in times of uncertainty within the financial system. Secondly, inflation expectations remain high and the dollar continues to weaken. Thirdly, central bank diversification out of US bonds is likely to benefit gold as central banks tend to increase their gold holdings in times of uncertainty and environments where risk aversion is prevalent. Fourthly, the recent double bottom at 85 on the GLD chart looks eerily similar to the double bottom at 80 we spotted on the USO chart back in March which ultimately presaged Oils parabolic move from the 80s to 140s. Take a close look at the USO chart below, paying particular attention to the mid March 2008 to early April 2008 double bottom at 80. Now stretch it out over a couple months rather than one month, and notice how closely it resembles the mid April to mid June double bottom at 85 on the GLD chart. They are almost perfect replicas and we believe we are at the same exact stage of the Gold breakout with respect to Oil....just beginning a major move to the upside. Moreover, with Oil nearly doubling over the past year and significant percentage gains made, it is likely that hedge funds and large institutions are now in search of the next asset class which may have greater potential for larger percentage gains down the road. This will likely lead them to Gold, as the asset class is similar and it keeps them highly hedged against inflation. Hence, with fundamentals as well as technicals in place we believe that Gold has potential to become the new Oil going into year end, and are looking for a very strong double top breakout over 100 in the GLD very soon. In this kind of environment, with inflation expectations running high as well as multiple looming bank failures there really is no limit to how high Gold can go. Would it surprise me to see $1500-2000/oz by year end? No. Based on these assumptions, we have been buying the September 100 GLD calls here and will likely sit on these until Gold breaks out over $1000. Also note that large institutions have been taking extremely large positions in these calls over the past few sessions, with over 60,000 calls being bought yesterday and over 110,000 in open interest. Second of all, we have also been buying the September 90 puts on the TLT which is iShares Lehman 20+ Year Treasury Bond ETF. It essentially tracks bond prices at the long end of the yield curve, and since we are bearish on bonds going forward we'd like to have some exposure to the downside move.